1.1 What is a REIT?

REITs are companies that collect investments from multiple investors and own income-producing real estate to earn capital appreciation and rental income. REIT act as a tax-efficient mechanism that owns a portfolio of assets. It usually has a specific structure which we will discuss later.

REITs trade in major stock exchanges and they offer a plethora of benefits to their investors and buyers such as instant liquidity, safety, diversification, affordability, etc. They allow anyone from the common crowd to invest and gain benefit from valuable assets, and properties and access dividend-based income and total returns.

Like mutual funds, ETFs, or individual stocks, REITs are a lucrative option for investors to gain benefits. For example, in mutual funds, investors pool money and a fund manager and his team invests in various securities assets and equities to produce a return and in exchange offers the investors a mutual fund unit, REITs also offer a unit but unlike individual shares, REIT units represent ownership of assets/real estate properties.

India had its first REIT in 2019 and now has three famous REITs in the stock market: Mindspace REIT, Brookfield REIT, and Embassy REIT. REITs were first introduced in a minimum lot size of 200 units and were valued at INR 50000 but SEBI then brought down the investment to INR 10,000 – INR 15,000 with a lot size of one. This was done to make them more accessible and increase their liquidity in the market.

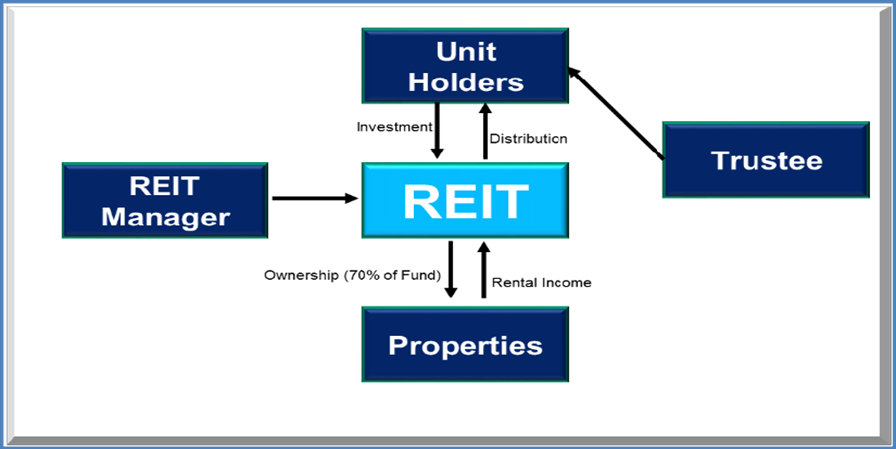

1.2 Structure of REIT

The structure of REITs is similar to Mutual Funds. They have a sponsor, a fund management company, and a trustee. The sponsor promotes and markets the funds and the fund management company buys the properties to build the portfolio. They work on an easy business model: by leasing out the properties and collecting the income through rent, the company then gives the dividends to its shareholders.

1.3 SEBI guidelines for REITs

SEBI has set some guidelines for REITs and they need to follow the following to be in accordance. These regulations are under Section 4 of the Regulations.

1. The trust deed is duly registered in India under the provisions of the Registration Act, 1908.

2. The trust deed has its main objective as undertaking activity of REIT in accordance with REIT Regulations.

3. Sponsor, manager, and trustee have been designated and are separate entities.

4. No unit holder enjoys superior rights over another unit holder and there is only a single class of units.

5. The corporation must have a minimum asset base of INR 500 crores.

6. The parties to the REIT are fit and proper persons as per the Schedule II of SEBI (Intermediaries) Regulations, 2008.

7. REITs need to payout 90% distributable cash flows to unit-holders.

8. REITs must have 80% of the total investment in income-generating assets. Only 20% should be made in under-construction assets to decrease the execution risk.

1.4 What you should look for while investing in a REIT?

1) Portfolio Occupancy Ratio

You should check the occupancy ratio, which is the ratio of occupied or rented space to the total available space. A high occupancy rate is an indicator of a good portfolio. This shows consistency in payouts, increased rental, and dividend income. The higher the occupancy, the more stable the cash flows.

2) Weighted Average Lease Expiry (WALE)

WALE is the average lease tenure remaining for the tenants living in the buildings included in the REIT portfolio. It is measured in years and shows the stability of the portfolio. Higher the WALE, the better because of less vacancy risk.

3) Geographical Diversification

REITs which have diversified portfolios across different micro and macro sectors are less prone to having problems with an oversupply of properties in one sector and reduced occupancy rates.

4) Distribution Yield

Distribution yield is the measure of distributable cash flows to the investors. It is not a guaranteed payout and depends on the trust performance. The higher the distribution yield, the better.

5) Sponsor/Developer Name

A reputed sponsor with a good track record and past performance will automatically mean a high-quality portfolio, stability, and asset management. REITs have the Right of first offer (ROFO) on properties that are owned by sponsors.

6) Net Asset Value

NAV is net asset value which is the estimated market value of the properties minus all liabilities divided by the number of shares outstanding. Oftentimes, REITs tend to trade below or above NAV because of the supply and demand of the traded units. But NAV is more accurate to determine the share price of REIT.

1.5 How to Invest?

REITs in India, just like stocks, are first launched through An IPO (Initial Public Offering) and FPO (Follow on Public Offer (FPOs). After the initial offer, REITs trade on the stock exchange where it is listed. You can buy units of REITs through regular trading accounts on BSE and NSE or any other major stock exchange.

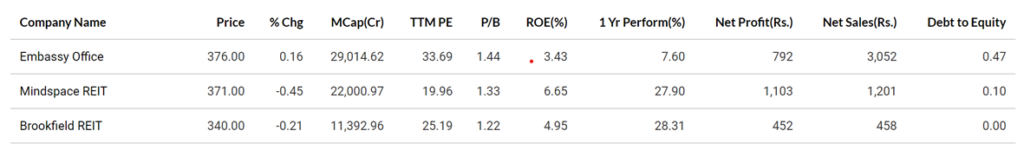

Peer Comparison of 3 major REITs

Read Our other Blogs too:

- Best Share Market Institute In DelhiAre you eager to explore the complexities of the stock market and unlock your investment potential? Look no further! The Investment Success Mentor (ISM) Institute in Delhi is your trusted partner in guiding you towards financial prosperity. With a stellar reputation and a dedication to empowering investors of all levels, ISM share market Institute stands … Read more…

- Best stock market training course in DelhiIn Delhi, if you’re seeking the best stock market training course, affordability is a crucial factor. The Institute of Stock Market offers comprehensive training at competitive fees, ensuring value for your investment. Their courses are designed to equip you with practical skills without burdening your finances. Stock market training fees can vary based on factors … Read more…

- Top 5 Best CFA Course in DelhiStarting the path to become a Chartered Financial Analyst (CFA) necessitates receiving thorough instruction and mentoring from respectable organizations. When it comes to choosing the best CFA course, prospective financial professionals in Delhi’s bustling metropolis have an abundance of options. The Institute of Stock Market (ISM) Institute is at the top of our list of … Read more…