A GUIDE TO RETURN ON EQUITY (ROE) | ITS USE & CALCULATIONS

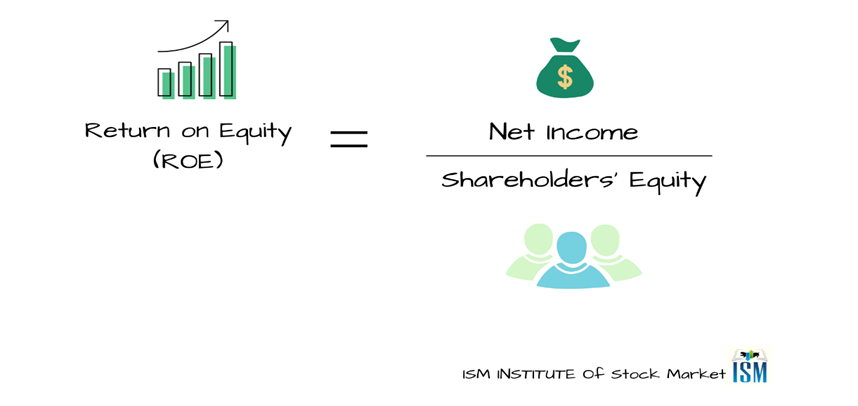

As the name suggests, Return on Equity (ROE) is the efficiency of a company in handling the shareholders’ money. It is calculated by dividing the net income by shareholder equity. It tells us how much return a company is generating on shareholders money. It is expressed in % so if the ROE of some company is 24%, it means on every Rs. 100 invested by a shareholder the company generated ₹24.

Formula

Now let’s understand the components of this formula,

First, Net Income is a firm’s profit after it has paid and accounted for all of the annual liabilities, it is calculated in the P/L account.

Net Income = Gross Income – Expenses

Shareholders’ Equity is the amount that shows a company’s residual assets to pay back to its shareholders. This is the fund that is left for the shareholders after the company has paid back all of its debts. It’s the total value of the firm’s assets minus the liabilities and is one of the three basic components of a balance sheet.

Shareholders’ Equity = Share Capital + Retained Earnings – Treasury Stock

Putting Values into the formula for calculating the ROE of a company XYZ Ltd.

Return On Equity (ROE) = 404/1699 = 0.2377 =23.77%

So, the ROE came out to be 0.2377 or 23.77% (after multiplying by 100)

This means that for every rupee invested in XYZ Ltd., its shareholders earn 0.25 rupees.

Return on Equity is used by potential buyers, lenders, and management to gauge past and future performance. Generally, a higher ROE is better, but sometimes, a high ROE can also mean an increasing debt or liabilities. So, a rule of thumb is an increasing ROE indicates a good company that generates value for its shareholders by reinvesting its earnings wisely. A declining ROE over time means a company has poor management and makes unseemly investment decisions.

Advantages of Return on Equity

– Determining a company’s growth sustainability: ROE ratio helps in determining the growth sustainability of a company. Investors and lenders use this financial ratio to identify and find stocks that are more vulnerable to market risks and instability.

– ROE can be used to estimate a company’s dividend growth. A more accurate approximation can be calculated by multiplying the company’s ROE with its payout ratio. The higher or lower the company’s dividend growth rate to the sustainable growth rate, the higher or lower the chances of operational mishaps.

– Calculating problems with the net income: a very high ROE ratio may signal a hidden issue with the company. These may relate to the net income. For example, if the company’s net income is considerably more than its equity then, a high return on investment (ROI) is great but if the equity is less than the net income then, it might indicate a hidden issue.

Disadvantages of Return on Equity

– Share buybacks can affect the return on equity ratio. This is because the number of outstanding shares is lowered when the company repurchases its shares from the market. As the denominator decreases, ROE increases.

– A negative ROE that comes from a company’s net loss or negative shareholders’ equity is unusable to compare with its previous years or to be compared with the industry or competitors with positive ROEs.

– Another drawback is that some ROE ratios disregard intangible assets when calculating the shareholder’s equity. Goodwill, trademarks, copyrights, and patents are examples of intangible assets. This leads to difficulty in drawing comparisons with other companies that opt to include intangible assets.

DuPont Formula

DuPont Corporation created a model called Dupont Analysis for analyzing a company’s profitability. This is a tool that helps to discard unnecessary false assumptions about a company’s profitability.

The DuPont method divides ROE into three parts:

The product of a company’s net profit margin, asset turnover, and financial leverage is called the Return on Equity (ROE) according to the DuPont Analysis.

Formula

ROE = Net Profit Margin X Asset turnover X Financial Leverage

ROE = Net Income/Sales X Sales/Total Asset X Total Assets/Shareholder’s Equity

If the net profit margin rises in due time it means that the company controls its operating and financial costs, and the ROE should increase. When the asset turnover ratio rises, it indicates that the company is making better use of its assets which is generating greater sales per rupee invested. And lastly, as the company’s financial leverage rises, it can use debt money to increase returns.

Conclusions

The Return on Equity ratio is a financial metric used to assess a company’s financial health and its capacity to create profitable returns for its shareholders over a specific time period. However, it cannot be the only criterion used to make investment decisions since it does carry its drawbacks. Other than ROE, investors can also calculate the return efficiency of a company by calculating its return on capital employed (ROCE) and return on operating capital (ROOC) to paint a complete picture.

The DuPont Analysis can be employed to get a more thorough understanding of the company and make a better investment decision.

Read our other Blogs: